A Fun and Potentially Lucrative Hobby

Supplementing my travel budget with credit card reward points

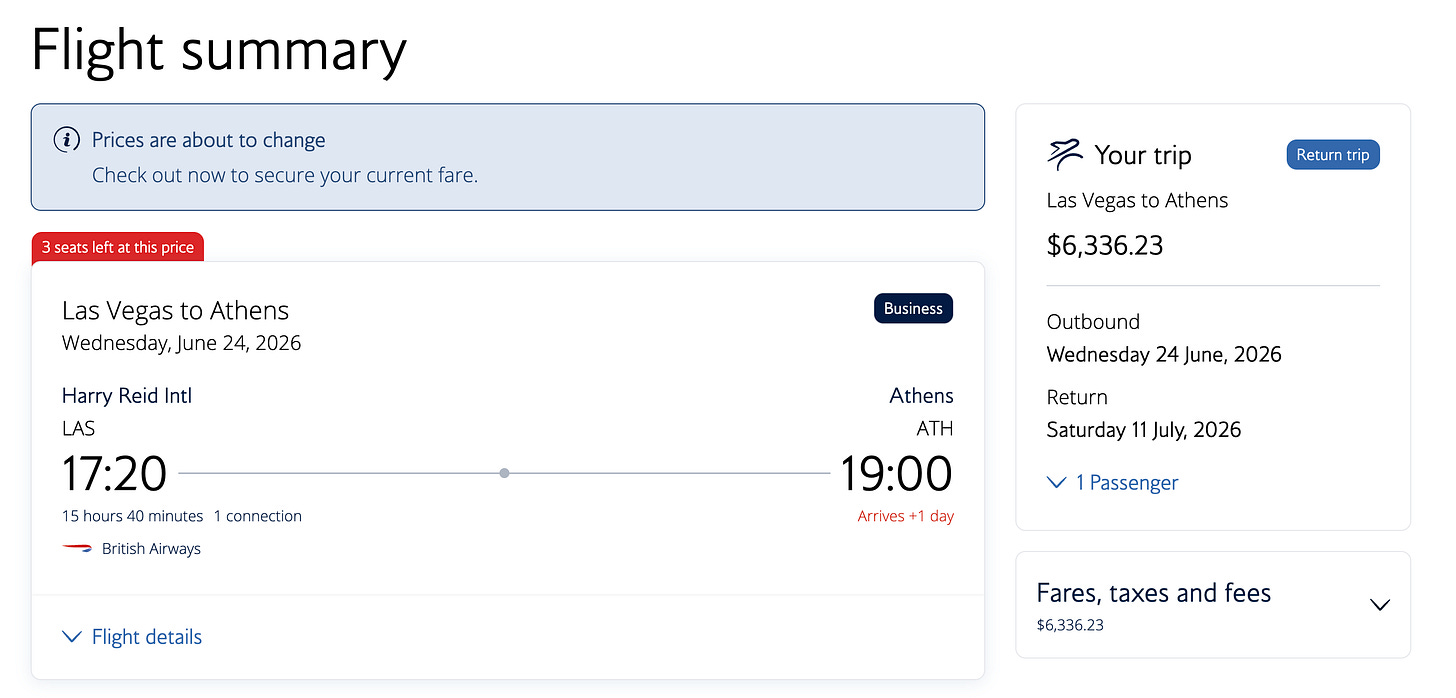

This summer I’m flying business class to Athens. Round trip. Peak season. Total out of pocket? $800 per person. I checked the going rate today. One business class ticket on that same flight is selling for $6,300.

I’m not racking up miles from business travel. I rarely take work-supported trips. I’m just someone who enjoys getting travel perks and strategizing to maximize them.

So today I want to share how I’ve been funding a good chunk of my travel budget through credit card signup bonuses. This isn’t about churning cards irresponsibly or carrying balances and paying interest. It’s about being strategic with applications you might make anyway.

The Game, Briefly

Credit cards want new customers badly enough to offer substantial bonuses for opening accounts. We’re talking 60,000 to 100,000 points for spending $3,000 to $6,000 in the first few months. For context, 100,000 points can easily cover multiple domestic round-trip flights or one nice international ticket.

Over the past few years, I’ve accumulated several hundred thousand points this way. I apply for a new card roughly every six months, meet the spending requirement through regular expenses like groceries, utilities, and insurance, then collect the bonus.

Two Cards That Have Worked for Me

The Chase Sapphire Reserve gets a lot of attention, and for good reason. Yes, the $795 annual fee makes you wince. I winced. But here’s the math that convinced me:

The credits add up fast. There’s $300 back through the annual travel credit that applies to flights, hotels, and more. Another $300 in dining credits. $300 for StubHub if you go to concerts or sporting events (even if you don’t think you would use this, you can buy a ticket and resell it to pocket the money). $250 for Chase Travel hotel bookings. $120 in Lyft credits.

Not all of these will fit your life. Some require activation and attention. But even using half of them offsets that fee pretty quickly. Add in the airport lounge access, which I didn’t think I’d care about but now genuinely appreciate (free drinks!), and the card starts looking different.

The British Airways card has been my other workhorse. I love Europe. Direct flights leave from Las Vegas on British Airways. After spending $30,000 in a year on the card, they give me a companion voucher. This means my wife flies along for just the taxes and fees on her ticket.

I combine saved points with that companion voucher to book premium economy or business class for roughly what coach would normally cost. This summer’s Athens trip? Business class seats are currently selling for $6,300 each. We’re paying $800 per person.

Is This Worth Your Time?

Maybe. It depends on a few things.

First, you need good credit. These cards require it. Opening a new card might cause a small, temporary dip from the credit inquiry, but the added available credit can actually boost your score over time.

Second, you need to pay your balance in full every month. The moment you pay interest, you’ve lost the game. The credit card companies are betting you’ll carry a balance. Don’t prove them right.

Third, you need to actually use the points. It sounds obvious but people sit on hundreds of thousands of points waiting for the “perfect” trip and then the points devalue or expire. Book the trip.

If those conditions work for you, this approach can add real flexibility to your travel budget. It won’t replace your savings, but it can meaningfully supplement them.

Making This Work for You

Start with one card. The Chase Sapphire Preferred is a gentler entry point than the Reserve if the big fee feels intimidating. Right now you can earn 75,000 bonus points after spending $5,000 in the first three months. Meet the spending requirement through expenses you’d pay anyway. Never carry a balance. Learn the transfer partners and booking strategies. Then decide if it’s worth adding another card to the rotation.

I’ll probably write more about specific booking tactics in future posts. For now I just wanted to get this idea on your radar in case, like me, you spent years not knowing this game existed.

Hit reply if you have questions or if you’ve been playing this game yourself. I’m always interested in what’s working for others.

Until next time,

Art

PS: I use these cards and recommend them. In a future post, I’ll share referral links that can be win-win offers benefiting each of us.